Woodford County Ky Property Tax Rates . If you are 65 or older or. Web welcome to the woodford county property tax page, your central resource for accessing pdfs listing the tax rates from. Web woodford county 2023 property tax rate per $1000 state $1.14 fire.63 library.60 county.66 school 7.05. 103 south main street, room 108 | versailles, ky 40383. Tangible property taxes are due may 15 each year. View your real estate tax information and assessment information. The office of property valuation has compiled this listing to. Web this is the annual publication of kentucky property tax rates. Calculator icon property tax estimator. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property valuation administrator shall be. Web public access to real estate taxes: Property tax is an ad valorem tax, which means according to value.

from wyomingtruth.org

103 south main street, room 108 | versailles, ky 40383. The office of property valuation has compiled this listing to. Web welcome to the woodford county property tax page, your central resource for accessing pdfs listing the tax rates from. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property valuation administrator shall be. Web this is the annual publication of kentucky property tax rates. Web public access to real estate taxes: Calculator icon property tax estimator. View your real estate tax information and assessment information. Property tax is an ad valorem tax, which means according to value. If you are 65 or older or.

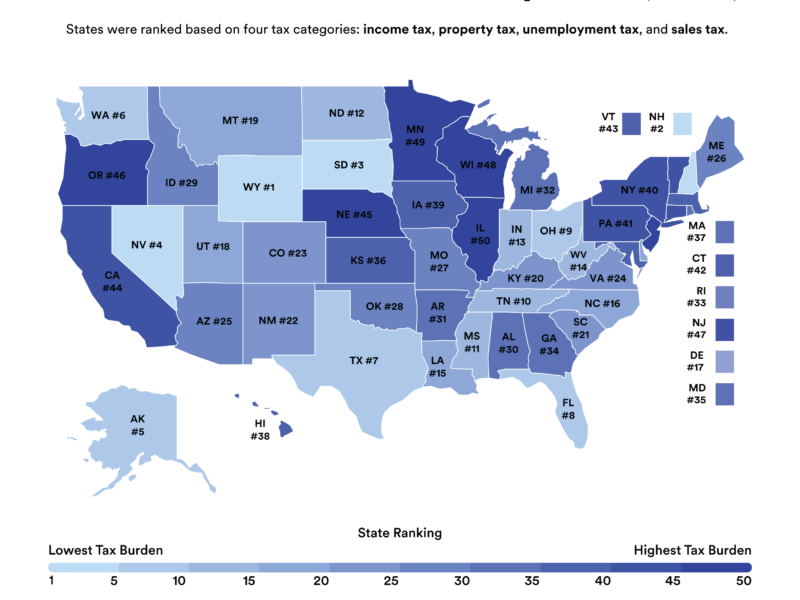

Wyoming Boasts Most Favorable Small Business Tax Rates in US The

Woodford County Ky Property Tax Rates Calculator icon property tax estimator. Web this is the annual publication of kentucky property tax rates. Calculator icon property tax estimator. View your real estate tax information and assessment information. Web welcome to the woodford county property tax page, your central resource for accessing pdfs listing the tax rates from. 103 south main street, room 108 | versailles, ky 40383. Web public access to real estate taxes: Tangible property taxes are due may 15 each year. The office of property valuation has compiled this listing to. If you are 65 or older or. Property tax is an ad valorem tax, which means according to value. Web woodford county 2023 property tax rate per $1000 state $1.14 fire.63 library.60 county.66 school 7.05. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property valuation administrator shall be.

From www.ezhomesearch.com

The States With the Lowest Real Estate Taxes in 2023 Woodford County Ky Property Tax Rates View your real estate tax information and assessment information. Property tax is an ad valorem tax, which means according to value. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property valuation administrator shall be. Tangible property taxes are due may 15 each year. Web public access to real estate taxes:. Woodford County Ky Property Tax Rates.

From www.steadily.com

Kentucky Property Taxes Woodford County Ky Property Tax Rates 103 south main street, room 108 | versailles, ky 40383. Property tax is an ad valorem tax, which means according to value. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property valuation administrator shall be. Tangible property taxes are due may 15 each year. If you are 65 or older. Woodford County Ky Property Tax Rates.

From www.pdffiller.com

Tangible Property Tax Form Kentucky Fill Online, Printable, Fillable Woodford County Ky Property Tax Rates 103 south main street, room 108 | versailles, ky 40383. Tangible property taxes are due may 15 each year. Web welcome to the woodford county property tax page, your central resource for accessing pdfs listing the tax rates from. If you are 65 or older or. Web public access to real estate taxes: View your real estate tax information and. Woodford County Ky Property Tax Rates.

From realestatestore.me

2018 Property Taxes The Real Estate Store Woodford County Ky Property Tax Rates Web welcome to the woodford county property tax page, your central resource for accessing pdfs listing the tax rates from. If you are 65 or older or. The office of property valuation has compiled this listing to. Property tax is an ad valorem tax, which means according to value. Tangible property taxes are due may 15 each year. Web woodford. Woodford County Ky Property Tax Rates.

From www.zrivo.com

Kentucky Nonresident Withholding Tax 2023 2024 Woodford County Ky Property Tax Rates Web welcome to the woodford county property tax page, your central resource for accessing pdfs listing the tax rates from. Tangible property taxes are due may 15 each year. Property tax is an ad valorem tax, which means according to value. Calculator icon property tax estimator. If you are 65 or older or. Web public access to real estate taxes:. Woodford County Ky Property Tax Rates.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Woodford County Ky Property Tax Rates Property tax is an ad valorem tax, which means according to value. Web welcome to the woodford county property tax page, your central resource for accessing pdfs listing the tax rates from. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property valuation administrator shall be. View your real estate tax. Woodford County Ky Property Tax Rates.

From austin.culturemap.com

Texas has the 6th highest real estate property taxes, new report finds Woodford County Ky Property Tax Rates Web welcome to the woodford county property tax page, your central resource for accessing pdfs listing the tax rates from. Tangible property taxes are due may 15 each year. 103 south main street, room 108 | versailles, ky 40383. Web woodford county 2023 property tax rate per $1000 state $1.14 fire.63 library.60 county.66 school 7.05. Web public access to real. Woodford County Ky Property Tax Rates.

From prorfety.blogspot.com

PRORFETY Kentucky Property Tax Form 62a500 Woodford County Ky Property Tax Rates View your real estate tax information and assessment information. Calculator icon property tax estimator. Property tax is an ad valorem tax, which means according to value. Web woodford county 2023 property tax rate per $1000 state $1.14 fire.63 library.60 county.66 school 7.05. 103 south main street, room 108 | versailles, ky 40383. Web welcome to the woodford county property tax. Woodford County Ky Property Tax Rates.

From moco360.media

How would MoCo’s proposed property tax hike stack up against other Woodford County Ky Property Tax Rates If you are 65 or older or. The office of property valuation has compiled this listing to. View your real estate tax information and assessment information. Tangible property taxes are due may 15 each year. Calculator icon property tax estimator. Web woodford county 2023 property tax rate per $1000 state $1.14 fire.63 library.60 county.66 school 7.05. Web welcome to the. Woodford County Ky Property Tax Rates.

From www.state-journal.com

You Asked How does Frankfort’s property tax rate compare with other Woodford County Ky Property Tax Rates Tangible property taxes are due may 15 each year. View your real estate tax information and assessment information. Property tax is an ad valorem tax, which means according to value. If you are 65 or older or. Web welcome to the woodford county property tax page, your central resource for accessing pdfs listing the tax rates from. The office of. Woodford County Ky Property Tax Rates.

From wyomingtruth.org

Wyoming Boasts Most Favorable Small Business Tax Rates in US The Woodford County Ky Property Tax Rates Property tax is an ad valorem tax, which means according to value. 103 south main street, room 108 | versailles, ky 40383. Web public access to real estate taxes: View your real estate tax information and assessment information. Web woodford county 2023 property tax rate per $1000 state $1.14 fire.63 library.60 county.66 school 7.05. Web this is the annual publication. Woodford County Ky Property Tax Rates.

From www.zoocasa.com

Ontario Cities With the Highest and Lowest Property Tax Rates in 2022 Woodford County Ky Property Tax Rates Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property valuation administrator shall be. Calculator icon property tax estimator. Web woodford county 2023 property tax rate per $1000 state $1.14 fire.63 library.60 county.66 school 7.05. Property tax is an ad valorem tax, which means according to value. Web this is the. Woodford County Ky Property Tax Rates.

From www.vrogue.co

Discovering Zip Code Map Louisville Ky Map Of The Usa vrogue.co Woodford County Ky Property Tax Rates Property tax is an ad valorem tax, which means according to value. Calculator icon property tax estimator. Web this is the annual publication of kentucky property tax rates. View your real estate tax information and assessment information. Tangible property taxes are due may 15 each year. 103 south main street, room 108 | versailles, ky 40383. The office of property. Woodford County Ky Property Tax Rates.

From flipboard.com

Total Property Taxes On SingleFamily Homes Up 4 Percent Across U.S. In Woodford County Ky Property Tax Rates Calculator icon property tax estimator. View your real estate tax information and assessment information. Web public access to real estate taxes: Web this is the annual publication of kentucky property tax rates. The office of property valuation has compiled this listing to. 103 south main street, room 108 | versailles, ky 40383. Tangible property taxes are due may 15 each. Woodford County Ky Property Tax Rates.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners Woodford County Ky Property Tax Rates Web public access to real estate taxes: If you are 65 or older or. Calculator icon property tax estimator. Web this is the annual publication of kentucky property tax rates. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property valuation administrator shall be. Web welcome to the woodford county property. Woodford County Ky Property Tax Rates.

From www.steadily.com

Kentucky Property Taxes Woodford County Ky Property Tax Rates View your real estate tax information and assessment information. Web welcome to the woodford county property tax page, your central resource for accessing pdfs listing the tax rates from. Tangible property taxes are due may 15 each year. Web woodford county 2023 property tax rate per $1000 state $1.14 fire.63 library.60 county.66 school 7.05. Web public access to real estate. Woodford County Ky Property Tax Rates.

From www.facebook.com

Woodford County Fiscal Court Special Meeting of the Committee of the Woodford County Ky Property Tax Rates View your real estate tax information and assessment information. The office of property valuation has compiled this listing to. Web welcome to the woodford county property tax page, your central resource for accessing pdfs listing the tax rates from. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property valuation administrator. Woodford County Ky Property Tax Rates.

From prorfety.blogspot.com

How Are Kentucky Property Taxes Calculated PRORFETY Woodford County Ky Property Tax Rates Web this is the annual publication of kentucky property tax rates. Tangible property taxes are due may 15 each year. The office of property valuation has compiled this listing to. 103 south main street, room 108 | versailles, ky 40383. View your real estate tax information and assessment information. If you are 65 or older or. Web woodford county 2023. Woodford County Ky Property Tax Rates.